Monthly Portfolio Review

December 2025

Hi Apes!🍌

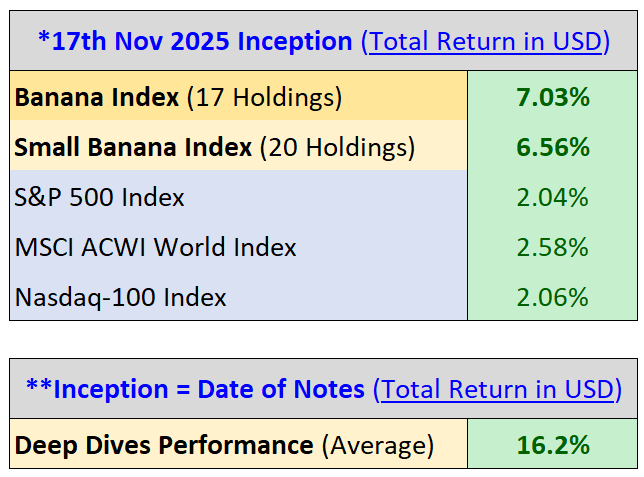

This is our monthly portfolio review, where we look at the performances of our respective portfolios and deep dives. For the new apes, we have the:

Banana Index: Best ideas within a global, unconstrained portfolio (15-25 stocks)

Small Banana Index: Best ideas limited to global companies under US$10 billion in market capitalization (15-25 stocks)

Our strong start continues across our portfolios. We remain fully deployed into the new year, but will start raising some cash particularly from the precious metals complex to preserve some optionality over first half this year.

Portfolio Rules

1. There is no day-trading, leverage, or options in these portfolios. As with my investment philosophy, I seek the best ideas with favourable risk/reward over 1-3 years. Also, leverage is usually where portfolios go to die :/ (don’t ask me how I know this)

2. Maximum of 10% cash position in each portfolio

3. There will be tactical buys/sells (maybe a few times per month) and I send these through the chat as and when I make the changes (remember to join the chat here if you haven’t)Keep reading with a 7-day free trial

Subscribe to Apeconomics to keep reading this post and get 7 days of free access to the full post archives.