Monthly Portfolio Review

January 2026

Hi Apes!🍌

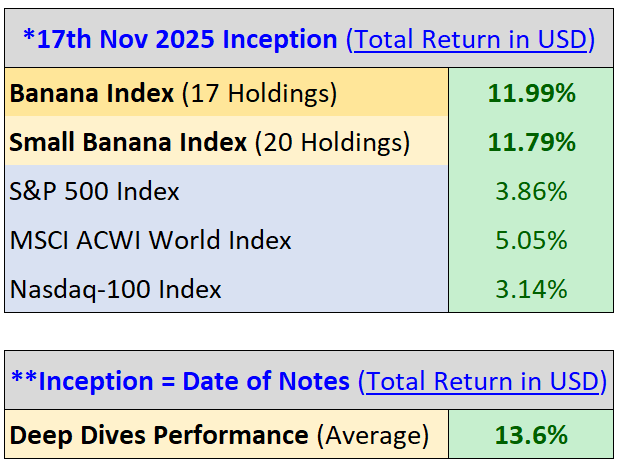

This is our monthly portfolio review, where we look at the performances of our respective portfolios and deep dives. For the new apes, we have the:

Banana Index: Best ideas within a global, unconstrained portfolio (15-25 stocks)

Small Banana Index: Best ideas limited to global companies under US$10 billion in market capitalization (15-25 stocks)

Our portfolios continue to build on a strong start and we are now pulling ahead of all market indices. We remain fully deployed here, but will look to raise some cash/rebalance away from the precious metals complex to preserve some optionality over first half this year.

Portfolio Rules

1. There is no day-trading, leverage, or options in these portfolios. As with my investment philosophy, I seek the best ideas with favourable risk/reward over 1-3 years. Also, leverage is usually where portfolios go to die :/ (don’t ask me how I know this)

2. Maximum of 10% cash position in each portfolio

3. There will be tactical buys/sells (maybe a few times per month) and I send these through the chat as and when I make the changes (remember to join the chat here if you haven’t)Keep reading with a 7-day free trial

Subscribe to Apeconomics to keep reading this post and get 7 days of free access to the full post archives.