Mental Model of an Ape

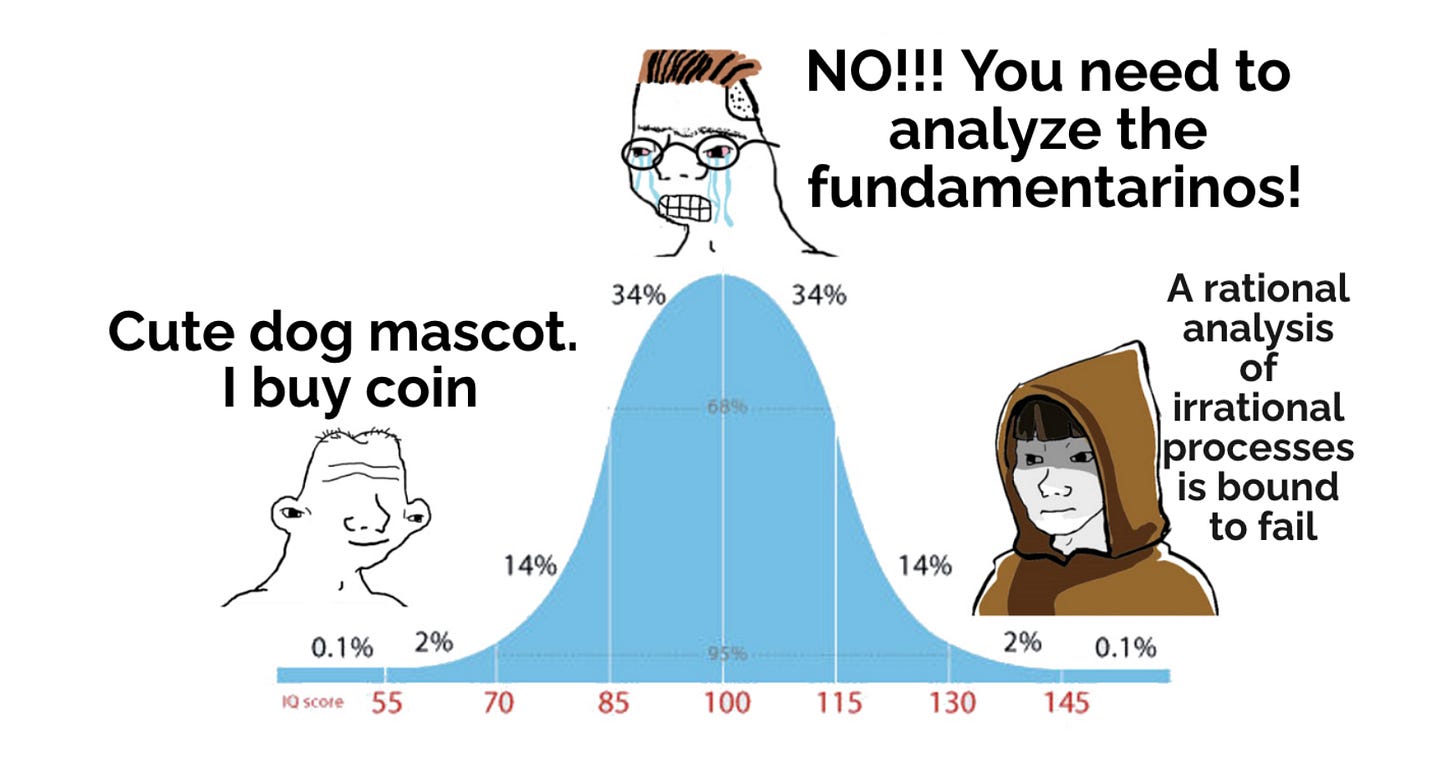

What you never want to be is mid-curve...

Hello!

My name is Taro Sakamoto (slim version), an assassin of the markets. At night, I’m an ape decked out in shorts, armed with a green crayon and 4 screens, trying to out trade my mum’s boyfriend.

I come from Asia where bananas are aplenty. Unlike other apes, I don’t have a morning routine of “Bananas-Ice Bowl-Saratoga Water” which supposedly makes one an invincible ape comparable to the likes of Genghis Khan. Why not you ask? Because I’m not a morning person at all.

Where I live, the US markets are open 10pm-5am, and that’s usually when I am the most awake. It is during the wee hours that I watch 69% of traders lose money by buying high and selling low, panic after the markets are almost done panicking, arriving last and betting the farmhouse.

The worst thing you can do in the markets is to be mid-curve, that’s what 69% of market participants are. You can either (1) Pray you become as lucky as the remaining 30%, or (2) Aim to be the elite 1% of left-curve apes attaining right-curve results.

- Stonley Drunkenmailer

That quote literally changed my life.

To win and distinguish oneself from the mid-curve crowd, you have to excel in identifying asymmetric set-ups. Real market wizards win by understanding and mastering Asymmetry. This exists in many different forms, across all schools of thoughts. For instance…

Macro: Identifying risk on & risk off environments /Global liquidity trends and implications for positioning /Market or country level macro affecting rotations & capital flows /Policies and impact on specific sectors

Fundamental: Valuation of company given underlying fundamentals (is it cheap relative to future growth and certainty of that growth) /Special situations /Deep value with a catalyst

Technicals: Classical chart patterns & momentum indicators with odds in your favour (cup & handle, ascending triangles, RSI divergences etc.)

I would describe my style (at its core) as an active swing trader with a 1-3 year investment horizon. Over time, it is my goal to help myself (and help you) beat the MSCI World + S&P Indices, ideally without a single calendar year of negative returns.

Unlike other delulu apes, I am humble enough to admit I will never be the best fundamental investor, the best technical trader, or the best global macro investor. I have long understood my true strength lies in picking things up from scratch somewhat faster than others, and re-assembling borrowed skills/frameworks/wisdom into a better, innovative whole.

Know thy self. Know thy enemy. A thousand battles. A thousand victories.

- Sun Tzu

As such, my style is best visualised as a combination of Macro-Fundamentals-Technicals. Macro tells me which asset classes, sectors and/or markets have the strongest tailwinds behind their back (you want to concentrate exposure in these). Fundamentals tell me what to buy and what can be held for longer term compounding. Technicals tell me when to buy and when to be active on portfolio risk management (adding/trimming positions).

Some very simple first principles from each “School of Thought” that work in terms of signaling bad risk/reward set-ups (vice-versa, reverse of all these is true for signaling good r/r set-ups):

Macro: Fiscal policy drives the old economy (earnings + momentum). Austerity and/or increasing state interference in the private sector are horrible for assets at the country level. Inflation and its corollary interest rate hikes are horrible for risk assets at the global level

Fundamentals: When a sector is hot, hyped up and capex increases exponentially, get out (prices and margins are bound to collapse - wonders of the capital cycle). Management teams can either be good operators or good capital allocators, if they suck at both, company is not worth buying

Technicals: When you have got death crosses just beginning for the 50/200 Daily/Weekly/Monthly moving averages, be patient and sit out. The opportunity cost of trying to bottom-tick such trend breaks is not worth the relative returns forsaken in favour of buying on a decisive trend reversal/ 200MA reclaim instead

One last thing, asymmetry often comes from being positioned away from the crowd. There is a critical nuance to note though - don’t be contrarian for the sake of it, but be contrarian and be right. That means your independent assessment should lead you to a conclusion that deviates from consensus. These are the most interesting and often, most rewarding opportunities.

It is simple math really → price of an asset goes up more when you foresee a reality and is eventually proven right, where only 1 out of the 100 market participants were initially positioned for the outcome = 99 marginal buyers remain.

On the other hand, you have consensus set-ups where 90 out of the 100 market participants are initially positioned for an outcome → all it takes is for expectations to disappoint ever so slightly for sellers to overwhelm buyers. Even if the bull case plays out, there are only 10 marginal buyers remaining.

This is one of my favourite videos from a GOAT that excelled in the markets by identifying what the market hates (for the wrong reasons), and bought assets for pennies on the dollar. Be contrarian and be right, rinse and repeat.

Oh, having retired for more than 15 years, he said the best opportunity in the market back in April 2024 was China - called the smack bottom right before inflection.

Anyways, with the philosophy of Apeconomics now laid out, I will be diving more into individual companies hopefully at least 2x a month. These will be interesting companies that are at least worth a spot on your watchlist.

Keep it simple apes!

Cheers,

Taro Sakamoto

nice, I also bought China in January 2024 :=)